Life Insurance

Life Insurance

Our Approach

01

Calculate & Plan

Meet to assess your life insurance coverage needs and calculate the right sum assured

02

Compare & Select

Present carefully selected life insurance policies with clear benefit comparisons

03

Complete & Care

Handle your documentation and provide ongoing life insurance policy support

Our Life Insurance Services

At Blossom Finmaart, we specialize in finding the most suitable life insurance plans to protect your family’s future. Our insurance consultant takes time to assess your income, liabilities, family needs, and future expenses to calculate the ideal coverage amount needed for your loved ones.

We assist you with policies from trusted insurance companies, making your selection process simple and informed. From pure term plans to pension options, we guide you through policy details, premium payments, and benefits in plain language. Our years of claim settlement experience ensures your family receives strong support when they need it most.

Life Insurance Plans

Contact us to discuss your life insurance needs or schedule a free consultation.

Term Insurance

Pure life coverage with high sum assured at affordable premiums.

Endowment Plans

Life coverage combined with guaranteed returns at maturity.

Child Plans

Secure your child’s future education and life goals with guaranteed payouts.

Pension Plans

Build a retirement corpus with life coverage and regular income options.

Money-Back Plans

Regular returns during the policy term with life coverage benefits.

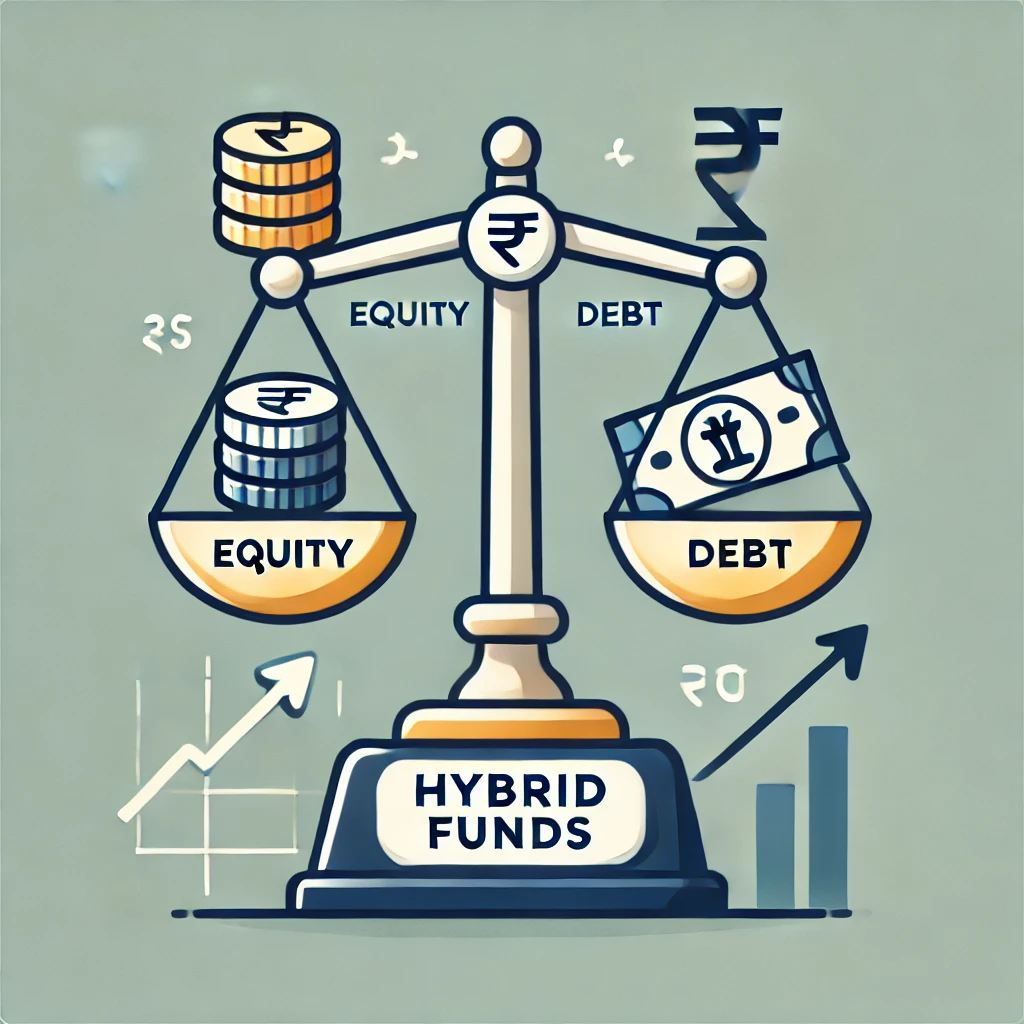

ULIP Plans

Market-linked returns with life coverage and investment flexibility.

WHY CHOOSE US

Insurance Advisory

The first step should indeed focus on calculating the appropriate life insurance coverage amount based on factors like:

- Income replacement needs

- Outstanding loans and liabilities

- Children’s education costs

- Family’s living expenses

- Other financial obligations

Our Support

- Personal attention from a life insurance expert

- Clear explanation of policy benefits

- Help with medical tests and paperwork

- Quick claim settlement assistance

- Regular policy reviews

- Fair premium comparisons

Contact us for a free consultation to discuss your family’s protection needs.